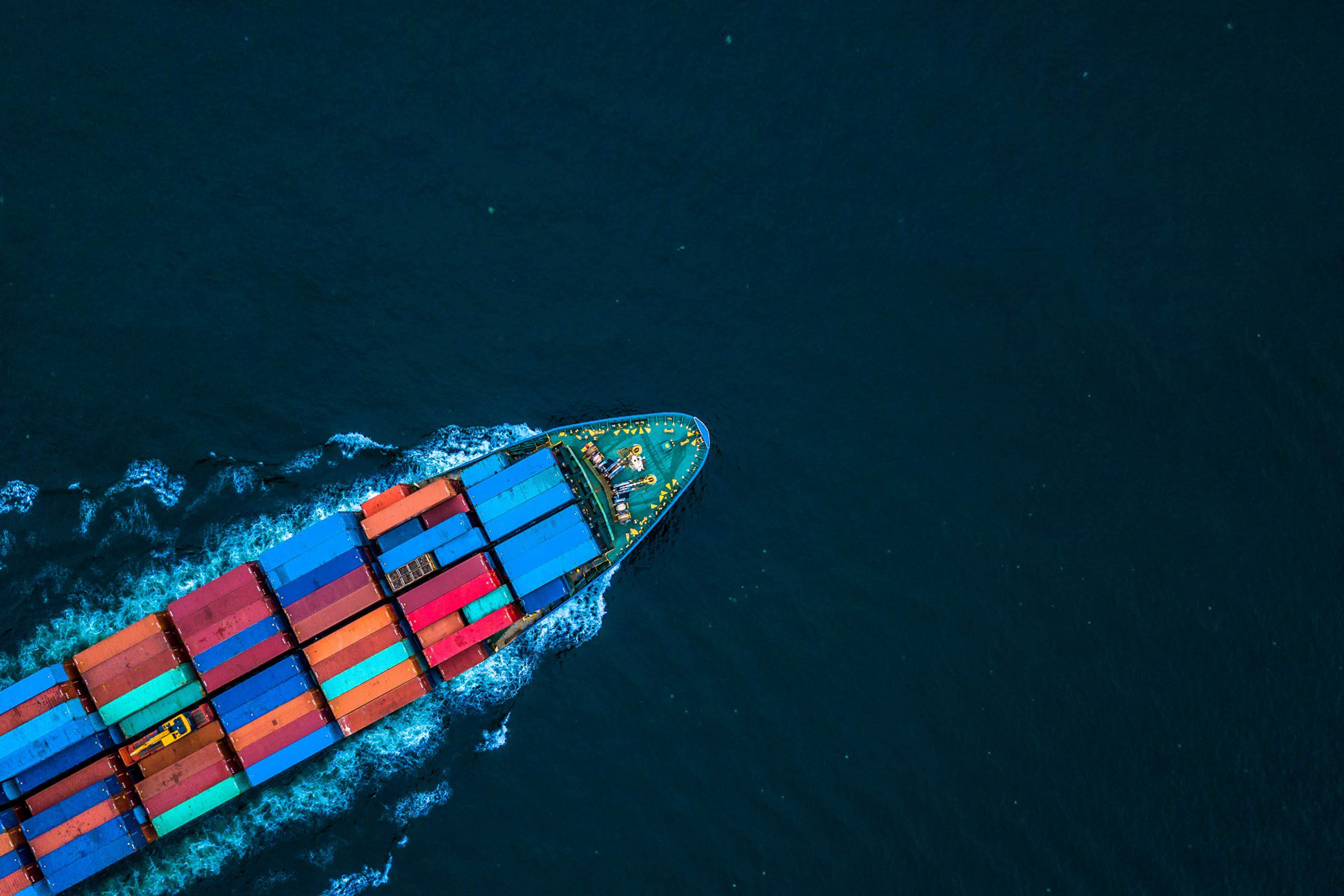

Global trade

Trade forms the backbone of the world’s economies, spurring investment, job creation, economic growth, and raising standards of living.

Global trade is being increasingly disrupted as tariff tensions, political unpredictability, protectionist policies and regulatory uncertainty challenge established business models and trade relationships.

The resulting inefficiencies were challenging when the trade environment was stable. But in our increasingly volatile times with COVID-19, Brexit as well as trade and political tensions at both local and global levels, the stakes are far higher.

Now should be a breakthrough era for international trade, as technological advances are making new forms of business possible, built on a foundation of data and insight. EY professionals can help you build an integrated approach by:

- Shaping responses to changing global tariffs and trading relationships

- Reducing cost, risk and delays from your trade network

- Driving better insights through data

- Reimagining your supply chain operating model

- Leveraging technologies

Refocusing on the global trade functional organization

EY Global Trade Updates

TradeFlash October 2023

Welcome to the newest edition of the TradeFlash newsletter, a roundup of the latest developments in global trade around the world.

Global Trade trends — including trade disruption, customs valuation, transfer pricing, and the interplay between trade policy and the ESG agenda — will continue to influence the trade policies of governments and the trade strategies of corporations into 2024 and beyond.

Refocusing on the global trade functional organization

As a result of multiple years of trade disruption and geopolitical tensions, companies are recalibrating, refocusing and re-establishing their interest in their global trade function’s organizational design. Consequently, as a “new norm” is established, clients have been raising topics, such as:

- Where should global trade sit within the company?

- What should be the scope of the global trade function?

- Should operational activities be separated from advisory and compliance activities?

- Should export be owned by legal?

These are a few of the key questions our EY tax professionals have contemplated with global trade executives and agree should be further examined.

TradeWatch Global Insights

The Global Insights section of our latest TradeWatch publication covers a wide range of trade topics and developments from around the world. On the agenda of this Issue 2:

- Refocusing on the global trade functional organization — a global trade perspective

- ‘Future-proofing’ the customs and trade function

TradeWatch Americas Insights

Under our Americas chapter, focus is on:

- Canada: Border Services Agency (CBSA) Assessment and Revenue Management (CARM) Release 2 update

- Latin America: maximizing the benefits of nearshoring — a practical guide to Latin America’s FTAs

- US: Section 301 update

TradeWatch Asia-Pacific Insights

The Asia-Pacific chapter features an article on Australia’s and New Zealand’s Landmark free trade agreements with the UK.

TradeWatch EMEIA Insights

Under the EMEIA chapter, authors discuss the impact on business of some key topics, including:

- EU: Customs legislation reform

- Kingdom of Saudi Arabia: growing network of special economic zones

- South Africa: between importers and clearing agents, who is responsible for customs compliance?

- UK: EY report on TradeTech and the digitalization of trade

Sustainability and ESG Insights

The impact of sustainability and environmental, social and governance (ESG) policies on trade is another key trend that we continue to explore. In this edition, we focus on:

- EU: final regulations published for new carbon border adjustment mechanisms (CBAMs) and Emission Trading System (ETS) revisions;

- UK: CBAM developments;

- The implications of an EU regulation aimed at minimizing deforestation risks associated with products that are placed on or exported from the EU market; and

- EU: Fight against global deforestation.

Previous TradeWatch and TradeFlash editions

TradeFlash July 2022

TradeFlash Feb 2022

TradeWatch 1, 2022

TradeWatch 3, 2021

TradeWatch 2, 2021

TradeConnect

How can you spend less time on tactical/transactional activities and more on strategic and focused activities that create value? One way is to turn to EY Trade Connect — a modular technology platform that links EY clients to a broad spectrum of managed services that can adapt and evolve with the changing needs of the business.

Read more about our global trade operation services