Rapid Value Creation

In virtually all industries today, companies are determining the best path to navigate the COVID-19 pandemic, geopolitical uncertainty and sector disruptions. Time is of the essence. Business leaders must consider and implement immediate actions for long-term success.

What EY can do for you

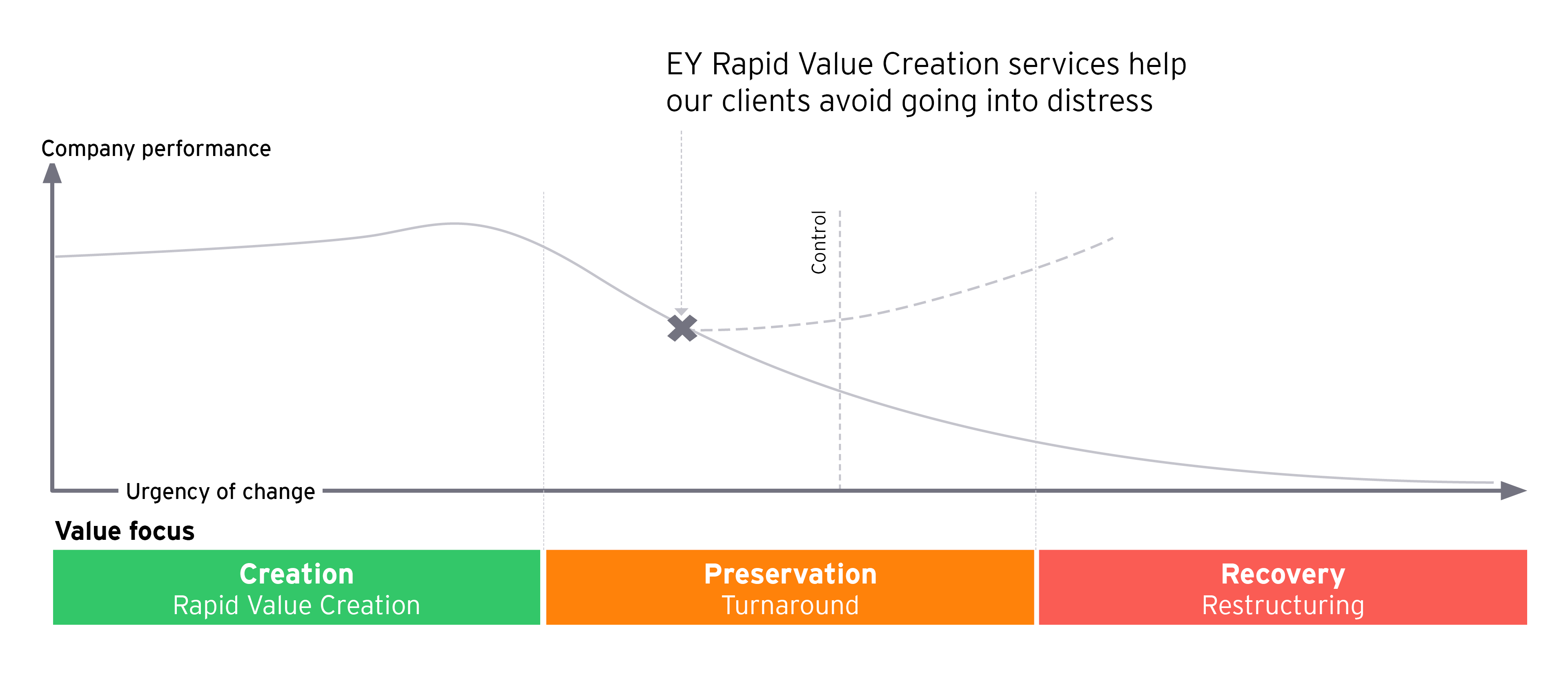

EY Rapid Value Creation services bring the breadth of our capabilities to help you reduce your costs and improve margin and liquidity, driving measurable results to reshape and transform your business.

Creation |

Preservation Turnaround |

Recovery Restructuring |

|

|---|---|---|---|

Indicators |

|

|

|

EY value proposition

- Proven track record of maximizing value

- Hands-on support from seasoned professionals, including interim management and contract research organization services

- A “future-back” perspective, incorporating a customer impact and investor lens

- Broad, integrated offering with full suite of industry, functional and operational capabilities

- Pragmatic and sustainable answers, not “slash and burn” strategies

- Promotion of a collaborative methodology to identify real opportunities with a focus on long-term value creation

Addressing your cost and capital needs today to fund your future for tomorrow

SG&A and operations

How can I streamline my business to be more cost efficient and resilient to fluctuations in revenues?

- Operating model: 35% of large companies say they are making good progress in their digital transformations. Source

- Labor productivity: 70% of organizations believe that productivity is a concern with remote working. Source

- Third-party spend: 50% of Fortune 100 companies' expenditures involve third parties. Source

- EY employs leading practice tools such as ZBB to identify which cost levers a company should pursue to maximize profitability.

Revenue and margin

What opportunities exist to optimize products and customers to drive topline growth and gross profit?

- Cost of goods sold: 41% of companies accelerating plans to automate as a result of the coronavirus. Source

- Price and promotions: 20% of manufacturer revenue invested on trade promotions. Source

- Customer demand: 75% of organizations selling direct to consumers will offer subscription services by 2023. Source

Capex and cash

How can we free up capital from operations that can be redeployed for growth or for a stronger balance sheet?

- Working capital: 5% of total revenue, average amount of working capital carried by companies.

- Capital portfolio: 3%-5% of total revenue, the average real estate costs at most companies.

- Tax savings: 25% of total personnel expenses, the average indirect tax burden at most companies.

Contact us

Contact our consultants to learn more about how Rapid Value Creation services

can transform your business